Cryptocurrency has become the focal point of today’s trading world and is expected to lead the market for years with crypto trading bots. These trading bots are increasingly becoming a vital part of modern life for those seeking passive income. Staying ahead of market trends and equipping yourself to make impactful decisions leads to better outcomes, and the trade bots perform such tasks efficiently. In this blog, we will dive into the strategies for building a successful passive income with cryptocurrency and the modern essence of these bots.

“The crypto trading bot market was valued at approximately $36.5 billion in 2023 and is projected to reach $135.7 billion by 2032” claimed Business Research Insight.

What are Crypto Trading Bots

Crypto trading bots are automated software that implement cryptocurrency trades on behalf of the end users using Artificial Intelligence and Machine Learning algorithms. Therefore, these bots require minimal human interference, can identify crypto investment opportunities, and can interpret market trends to earn passive income 24/7.

Types of Trading Bots

Different trading styles and market dynamics entitle specific types of bots to perform effectively. Choosing the right trading bot is essential to succeed in the world of crypto trading.

Some of the most popular types of trading bots are:

Arbitrage Bots:

Arbitrage bots buy cryptocurrency at a lower price on one platform and sell it at a higher price on another, earning a profit from the price difference. They utilize the price difference between different markets.

Market-Making Bots:

Market-making bots actively place both buy and sell orders, seeking to earn a profit from the price difference, also known as the spread, between these transactions. These bots determine a certain price level that remains around the market price.

Trend-Following Bots:

These bots identify the market trends and capitalize accordingly. These bots buy crypto when the market price is rising and sell while it’s lowering.

Grid Trading Bots:

Grid trading bots create a series of buy and sell orders around a specific price level within predefined intervals. These bots generate profit by buying at lower prices and selling at higher prices, taking advantage of price fluctuations within the grid.

Mean Reversion Bots:

These bots work on the principle that the price of the crypto eventually reverts to an average price. They tend to buy when the prices drop below the average while sell when prices rise above it, making a profit to the mean.

Why You Should Consider Crypto Trading Bots

There are multiple reasons to consider these bots that might lead you to generate passive income using cryptocurrency. Some of the reasons are:

- 24/7 Automated Trading: These bots are optimized to follow a pathway created by a trader. Once the trading parameters and strategies are set, these bots can trade without human intervention 24/7.

- Emotion-Free Trading: The bots do not consider the emotional factor while making decisions in trading practices. They rely on the data gathered from the market trends and act accordingly.

- Efficient Outcomes: The trader can optimize the strategies to generate efficient outcomes and returns. These bots follow the pre-set strategies to generate profits for the traders.

- Live Data Gathering: These crypto trade bots analyze different exchanges and markets to conclude whether to sell or buy cryptocurrency.

- Profit and Risk Estimation: These bots are also helpful in estimating risks and profits by analyzing the global crypto market. They can determine the profit or risks involved with a specific market.

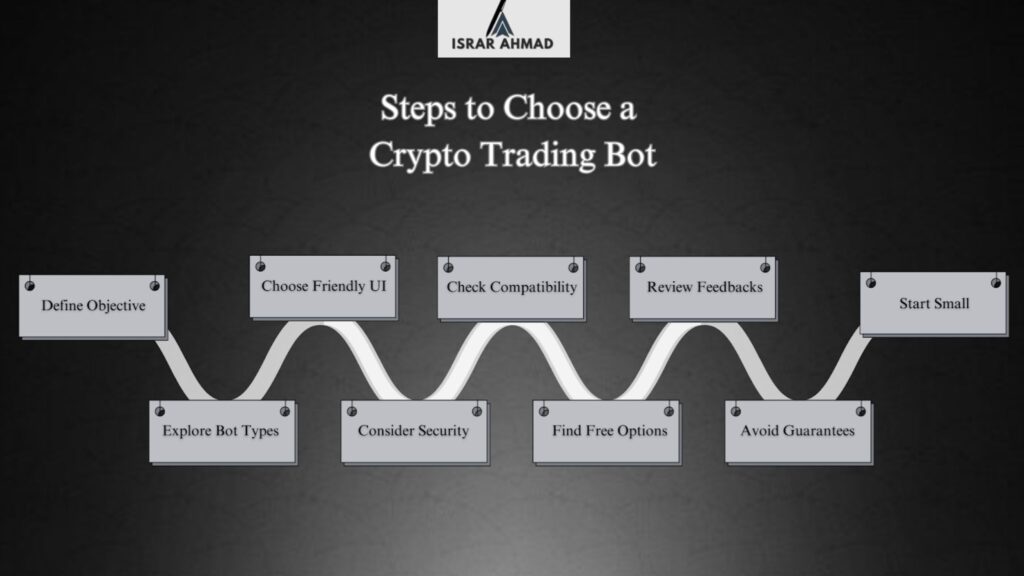

How to Choose Crypto Trading Bots

Choosing a crypto trading bot as a beginner could be challenging and exhausting. Understanding your needs and taking a systematic approach is key to selecting the right bot for your goals. Here’s a guide on how you can consider choosing your first trading bot:

Step 1: Define Your Trading Objective:

Determine your goals before allowing a bot to take over your trading practices. Whether you are seeking long-term growth or short-term gains, this will help you select the most suitable bot.

Step 2: Explore Different Bot Types:

Familiarize yourself with the different types of bots mentioned above and their unique offerings. Select the bot that closely aligns with your trading style and market approach.

Step 3: Consider User-Friendliness:

Choose a bot that provides an easy-to-use interface and straightforward instructions. As a beginner, selecting a bot that helps you learn the process with its simple and intuitive dashboard is important.

Step 4: Research Security Features of Crypto Trading Bots:

Prioritize security while choosing a bot for your crypto trade process. Two-factor authentication (2F), encryption, and secure APIs could be a few factors you should consider to safeguard your data and funds.

Step 5: Examine Exchange Compatibility:

To avoid unnecessary complications during your trade process and setup, check the bot’s compatibility with your desired platform. Understand that not all bots are compatible with every crypto exchange platform.

Step 6: Explore Free or Low-Budget Options:

You can familiarize yourself with these crypto bots without investing a significant fund. Multiple platforms offer free or low-budget options to explore allowing you to gain experience.

Step 7: Review Testimonials and Feedback:

Before committing to a bot, take the time to explore its online reviews, testimonials, and community feedback. Insights from other users can provide valuable guidance, helping you make a well-informed and confident decision about its reliability and functionality.

Step 8: Don’t Fall for Unrealistic Promises:

Follow the realistic data and don’t fall for the bots claiming guaranteed profits and extraordinarily high returns. The crypto market is structurally volatile and no bot can eliminate that factor. Choose a more reliable and realistic bot.

Step 9: Start Small and Scale Gradually:

Start trading with a small investment once you have finalized the bot. This approach helps you manage risks while gaining valuable experience. As you become more comfortable with investments, you can increase the process gradually.

Follow these steps and choose a bot that aligns with your crypto trading goals. These guidelines will help you make an informed decision and safeguard your investment in cryptocurrency.

Conclusion

Crypto trading bots can help you achieve passive income by streamlining the trading process. Among the types of bots available, selecting one that fits your trading style and taste becomes important to grow in crypto trading. Success lies in choosing the right one that offers ease of use, security, and a well-built market reputation to achieve the desired result. Explore the world of crypto trading while keeping yourself informed, and strategized.

Frequently Asked Questions

- Are crypto trading bots safe?

Most crypto trading bots have better security features including encryption, two-factor authentication, and API encryption. The traders are suggested to choose reputable bots to ensure the security of their funds and data.

- Is it possible to use multiple bots simultaneously?

Yes, you can target multiple cryptocurrencies and markets simultaneously using the bots. However, handling multiple bots could be challenging and might require close attention.

Explore More Technology Articles

Pingback: Why NFT Tokenization is the Future of Asset Ownership - Israr Ahmad